Anil Ambani, once a billionaire and powerful business tycoon, is back in the headlines after the Enforcement Directorate (ED) raided multiple offices of his Reliance ADA Group. The allegations involve a massive ₹3,000 crore loan fraud. This comes at a time when his companies were starting to rebound with profits and expansion into defense and renewables.

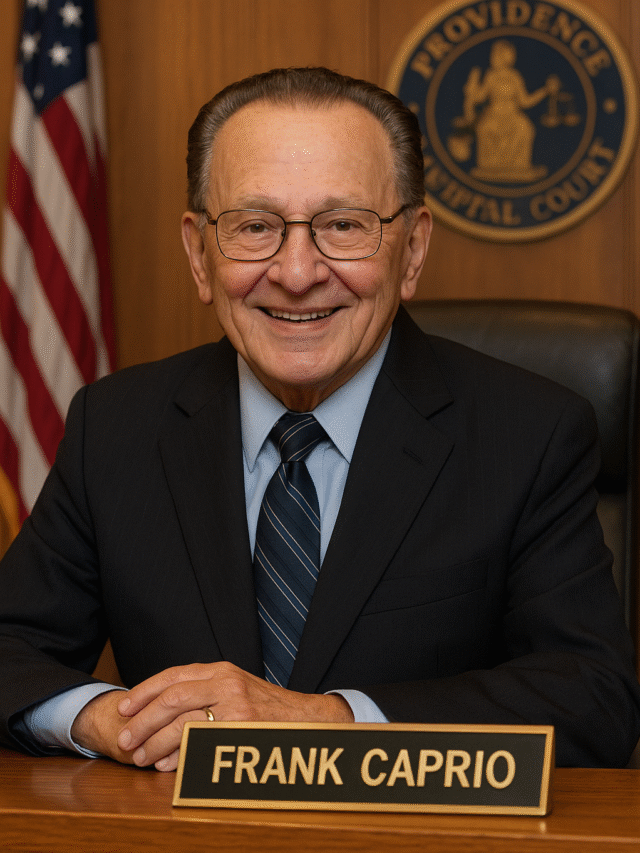

Who Is Anil Ambani?

Born on June 4, 1959, Anil Ambani is the younger brother of India’s richest man, Mukesh Ambani. In 2005, the Ambani brothers split the Reliance empire. Anil took control of businesses like telecom (Reliance Communications), power Reliance Powerand infrastructure (Reliance Infra).

Initially a rising star in Indian business, Anil’s fortunes fell sharply due to business failures and massive debts. His net worth reportedly dropped to zero by 2020 after legal troubles, loan defaults, and regulatory bans.

ED Raids: July 24, 2025

On July 24, 2025, the ED raided over 35 offices and properties linked to Anil Ambani across India. The raids are part of a probe into an alleged ₹3,000 crore money laundering scam involving loans from Yes Bank taken between 2017–2019.

Key Allegations:

- Loans taken through shell companies and siphoned off

- Bribery of bank officials to secure and manipulate loans

- False documentation and backdated credit approvals

This probe is part of a broader crackdown on financial fraud involving Indian corporates.

Group Companies React

Reliance Infrastructure and Reliance Power confirmed the ED action andanil ambani issued statements assuring full cooperation. They denied any wrongdoing and stated that the investigation pertains to past transactions.

Stock Market Reaction

The raid news shook investor confidence. Shares of Reliance Infra and Reliance Power Newsdropped around 5% in intraday trading. This came as a shock because both companies had recently seen a significant rally on the stock market due to better earnings and new project announcements.

Financial Recovery in 2025

Before the raids, Anil Ambani’s firms had begun staging a surprising comeback:

Reliance Power

- Q1 FY26 profit: ₹45 crore (vs ₹97.85 crore loss YoY)

- EBITDA: ₹565 crore

- Improved debt servicing and investor interest

New Projects

- ₹2,000 crore solar project in Bhutan

- Jet manufacturing facility in Nagpur

- Expansion into defense and EV sectors

SEBI Ban and Previous Legal Issues

In 2024, SEBI banned Anil Ambani and several group firms from accessing the securities market for 5 years. The ban was due to the diversion of funds from publicly listed companies and failure to disclose key financial details.

Consequences included:

- ₹25 crore fine

- Asset freezes

- Ongoing court supervision

Strategic Comeback Plan

Despite legal challenges, the group is attempting to reshape its future through diversification:

- Focus on green energy and solar power

- Defence manufacturing partnerships with foreign firms

- Entry into EV and battery storage markets

Market experts were optimistic about this turnaround—until the ED investigation raised fresh doubts.

What Makes This Case Serious?

This time, the ED’s findings could lead to criminal charges. The presence of bribery, shell companies, and misuse of public money makes this more severe than past regulatory actions. Public trust, which was slowly returning, could erode again.

Public Perception & Reputation

Anil Ambani was once a symbol of India’s rising economic power, but today his name is more often linked to bankruptcy and legal cases. His wife, Tina Ambani, continues her philanthropic and cultural work, but the family’s business empire is in the spotlight for the wrong reasons again.

What’s Next?

Three possible scenarios emerge:

- Legal escalation: If ED files formal charges, assets may be seized, and bail or arrests could follow.

- Controlled recovery: If no major fault is proven, the business may continue its slow comeback.

- Collapse: If fraud is confirmed, investor confidence will vanish, and debt may spiral again.

Timeline of Key Events

- 2005: Ambani brothers split the Reliance empire

- 2020: Anil declared bankrupt in UK court

- 2024: SEBI bans him from securities market

- 2025: Group makes profits and expansion moves

- July 24, 2025: ED raids 35+ properties over ₹3,000 crore fraud

🧾 Conclusion

Anil Ambani's journey—from billionaire to bankrupt to a comeback hopeful—now hangs in the balance. The recent ED raid could either derail his recovery plans or turn out to be another temporary roadblock. Either way, 2025 will be a decisive year for the Ambani name beyond Mukesh’s shadow.