The Indian rupee, along with global currencies, has also fallen to a new low against the US dollar due to the continuous exit of FPIs from India,

and inflation has risen to a 14-month high, leading to a cautious rally in the market.

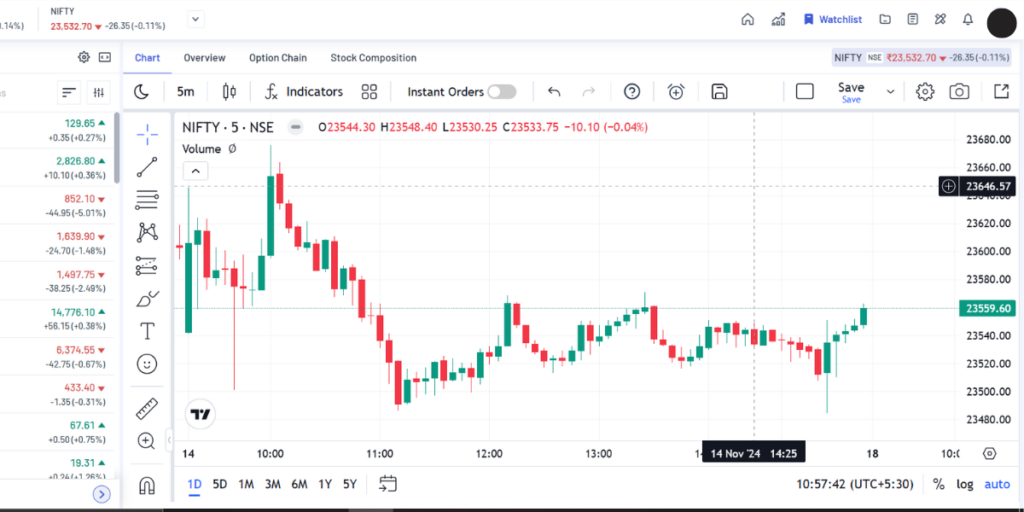

The Sensex closed 984 points lower at 77,690, while the Nifty Futures Index closed 263 points lower at 23,696. The Bank Futures Index closed 881 points lower at 50,492.

The fear of overvaluation has become a reality and large gaps are being seen in the prices of many stocks. As if retail investors were stuck, stock prices were being seen breaking on low volume.

Although the investment flow through SPI was seen increasing in the month of October, experts are now saying that this flow has started to slow down and in

the face of a possible rush of redemptions in mutual funds of retail investors, there is a risk of the situation in the market going out of control.

Top gainers in today’s trade include Adani Enterprises, Kotak Mahindra Bank, Reliance, Oberoi Realty, Voltas, Bata India, Tata Chemicals, Ramco Cement, Jindal Steel, Sun TV Life.

Top losers include TCS, Larsen, Mahindra & Mahindra, Torrent Pharma, Lupin, Aurobindo Pharma, Axis Bank, Sun Pharma, Infosys, HCL Technologies, Adani Ports, Wipro, State Bank of India.

Out of the total 4050 scrips traded on BSE, the number of losers was 1813 and the number of gainers was 2145, no change was seen in the price of 92 stocks.

While 02 stocks had a lower circuit of bearishness of only sellers, against 15 stocks having an upper circuit of bullishness of only buyers.

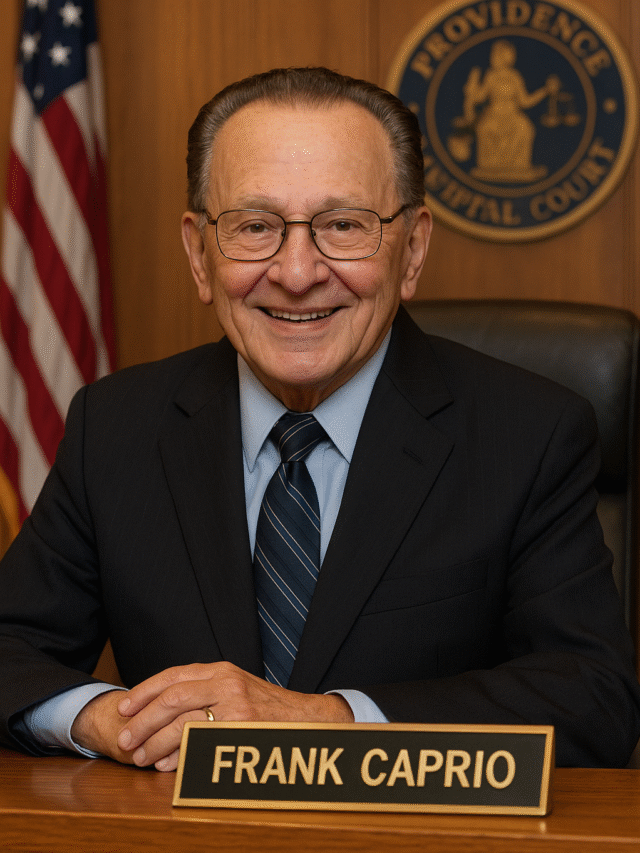

Nifty Future Technical Levels

Nifty Futures Closed:- (23621):- In the upcoming uptrend, Futures is likely to touch the very important levels of 23676 points to 23707 points, 23770 points with the first and very

important strong stop loss of 23373 points and 23303 points. Carefully create positions around 23303 points.

Bank Nifty Future Technical Levels

Bank Nifty Futures Closed:- (50333):- In the upcoming uptrend, Banknifty Futures is likely to touch the important levels of 50404 points to 50530 points, 50606 points with

the first and very important strong stop loss trading at 50088 points and 49808 points. Carefully create positions around 50088 points.

Specific technical levels regarding future stocks

Grasim Industries (2541):- The share price of this leading company of Aditya Birla Group is currently trading around Rs.2508.

This stock, which is worth buying with a stop loss of Rs.2488, is likely to register a price of Rs.2574 to Rs.2580 in the short term…!! Focus on bullishness above Rs.2600.

Infosys Limited (1865):- According to the technical chart, a positive breakout around Rs.1848…!!

This stock is worth buying from the support of Rs.1833 and is likely to register a price of Rs.1880 to Rs.1900.

Hindustan Unilever (2396):- According to the technical chart, this stock of Diversified FMCG sector has a potential

target price of Rs. 2360 to Rs. 2323 through profit-taking around Rs. 2464. Keep in mind the stop loss of Rs. 2500 for trading.

Muthoot Finance (1780):- This stock is worth selling with a stop loss of Rs.1818, registering an overbought

position around Rs.1808..!! It is likely to show a price of Rs.1757 to Rs.1744 in phases…!! Pay attention to the bullish trend above Rs.1830.

The future direction of the market...

Friends, the Goods and Services Tax (GST) Council is likely to give relief in GST on health and life insurance premiums in its December meeting.

The council meeting was earlier scheduled to meet this month but will now be held on December 23 and 24.

The Finance Ministry said that the council meeting has been held in December as Finance Minister Nirmala Sitharaman is currently meeting the finance ministers of various states in preparation for the upcoming budget.

The Group of Ministers on GST has recommended giving relief in GST on health and life insurance premiums.

The proposed relief in GST rates on life insurance premiums is estimated to reduce the government’s revenue by Rs 200 crore, which is proposed to be compensated by increasing rates on other goods.

The victory of Donald Trump as the US president has been seen as likely to have an impact on foreign direct investment in India.

However, new areas for FDI are emerging in India which are expected to sustain FDI flows in the event of a US withdrawal.

During its previous term, the Trump administration had made several regulatory changes to attract investment to

the US which had an impact on FDI inflows in many countries around the world, including India.