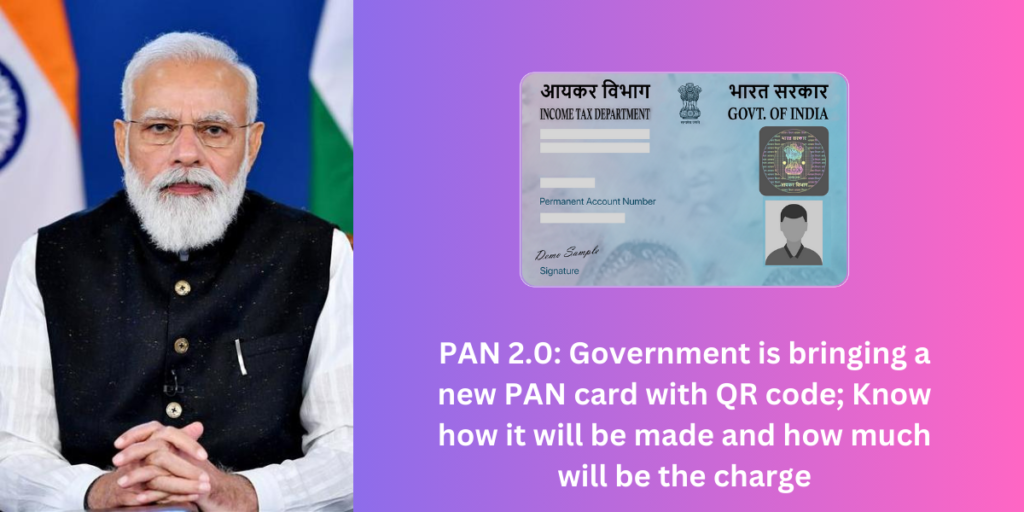

The central government has approved the PAN 2.0 project of the Income Tax Department. Now people will soon get a new PAN card with QR code facility, which will be in accordance with the government’s ambitious campaign Digital India

In such a situation, many questions are arising in the minds of people. Such as what is a PAN card, how is a PAN card made, what will happen to the old PAN card now, why is a new PAN card being made, will any fee have to be paid for it. Let us know the answers to these questions.

What is PAN card?

Permanent Account Number (PAN) is issued by the Income Tax Department. It is mostly used for financial purposes. Such as paying income tax, opening a bank account or buying property. PAN Card is a 10-digit number, which contains all the information related to your financial transactions.

Such as how much income you have, how much tax you pay, etc. It also contains complete information related to your investments.

Why is the government introducing a new PAN card?

The central government has talked about introducing PAN 2.0 for PAN QR code upgrade. According to Union Minister Ashwini Vaishnav, the PAN 2.0 project is an e-governance initiative aimed at making the use of PAN easy and secure, from PAN authentication to PAN QR code.

He said that the software operating the PAN card is 15-20 years old, which needs to be upgraded. Through PAN 2.0, the government wants to give a better digital experience to taxpayers.

How to get a new PAN card?

If you already have a PAN card qr code , then you do not need to do anything. You will get a new PAN card. There is no fee for this either. It will be delivered to your address. However, if you do not have a PAN card, then you will have to apply for a digital or physical PAN card.

What will be new in the new PAN card?

The new PAN card will have features like QR code (QR code PAN card), which will improve user experience. The government’s aim is to make the PAN 2.0 project more useful under Digital India.

It can also play an important role in taking advantage of government schemes. This is the reason why the government is putting a lot of emphasis on linking PAN and Aadhaar.

How to make a PAN card?

Talking about PAN card, it is also as important a document as Aadhaar card. Especially, in financial matters, its importance becomes more than Aadhaar card. You can get it made both physically and digitally.

The Income Tax Department has made many PayNearby and retail stores as PAN Service Agency (PSA) to get PAN card made physically. This includes grocery stores, mobile recharge outlets, travel agencies etc.

At the same time, to get a PAN card made online, you can apply for Instant e-PAN for free through the Income Tax e-filing portal. However, only those adult individual taxpayers who do not have a PAN yet can avail the benefit of free e-PAN.

Their valid Aadhaar should also be linked to their mobile number. If you get a new PAN card made after losing or damaging it, you may have to pay a fee of about Rs 100.

Process to get a PAN card

- Visit your nearest PAN service agency.

- Apply there to get a new card.

- Provide mobile number for OTP verification.

- Provide name, Aadhaar number and personal details.

- Select the option from eKYC or scan-based.

- Rs 107 will have to be paid for physical PAN card.

- There will be a charge of Rs 72 for ePAN card.

- eKYC authentication will take place after PAN card payment.

- Upload documents after eKYC authentication.

- Enter the OTP received on your mobile and submit.