UnitedHealth Group (NYSE: UNH) has been making headlines recently — not only because of its stock’s sharp swings, but also due to a bold investment move by Warren Buffett’s Berkshire Hathaway. As the largest U.S. health insurer, UnitedHealth plays a critical role in the healthcare ecosystem. Yet, the company is now facing a unique mix of investor confidence and operational headwinds. In this blog, we’ll unpack the latest developments, earnings trends, legal issues, leadership changes, dividends, and what the future might hold for UNH stock.

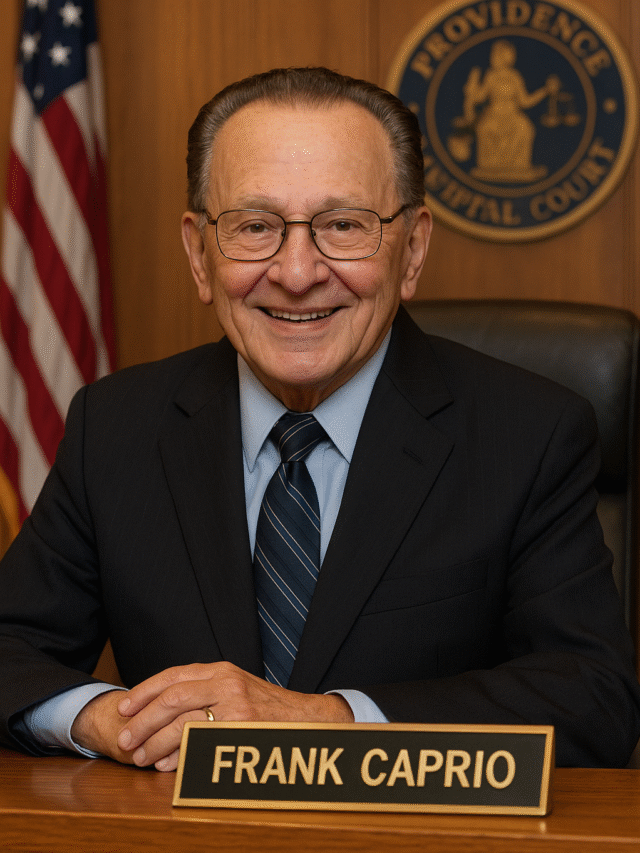

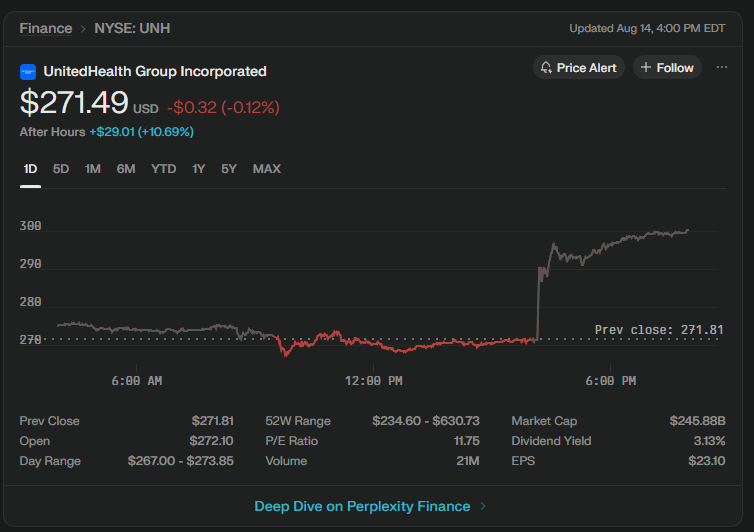

Current Market Overview

As of the most recent close, UNH stock is trading at $271.49, down slightly by 0.12 points (-0.00044%) from the previous session. Intraday movements have been volatile, with a high of $300.63 and a low of $267.19. This fluctuation reflects both short-term market sentiment and broader concerns about healthcare cost inflation and regulatory scrutiny.

Despite being a Dow Jones Industrial Average component, UNH has become one of the worst-performing Dow stocks in 2025. This underperformance is tied to earnings disappointments, legal probes, and rising costs — but recent events suggest some big players see long-term value.

Buffett’s Berkshire Hathaway Buys Big

In a move that grabbed Wall Street’s attention, Warren Buffett’s Berkshire Hathaway disclosed the purchase of 5 million shares of UnitedHealth Group, valued at approximately $1.6 billion. This purchase, revealed in a 13F filing, triggered an after-hours surge in UNH stock as investors interpreted the move as a strong vote of confidence.

Historically, Buffett’s investments in healthcare have been selective and long-term oriented. His entry into UNH suggests that, despite current turbulence, the underlying fundamentals and market position of UnitedHealth remain compelling.

- Keyword highlights: Buffett buys UNH, Berkshire Hathaway stake, long-term healthcare investment.

Q2 2025 Earnings: A Miss That Shook Investors

UnitedHealth’s Q2 2025 results fell short of Wall Street expectations. Adjusted earnings per share (EPS) came in at $4.08, well below the consensus of $4.48. While revenue grew 12.9% year-over-year to $111.6 billion, this wasn’t enough to offset rising medical costs.

The company also slashed full-year EPS guidance to about $16, down from an earlier projection of $26–$26.50, and far below the analyst consensus of $20.64. This sharp downgrade sparked concerns about profitability in the coming quarters.

One key metric raising red flags was the medical cost ratio (MCR), which climbed to 89.4% — a 430 basis point increase year-over-year. This reflects higher claims expenses, especially in Medicare Advantage, where utilization rates have been rising.

- Keyword highlights: UNH earnings miss, Q2 2025 results, medical cost ratio, profit guidance cut.

DOJ Probe Adds Legal Pressure

Compounding the financial challenges, UNH stock the U.S. Department of Justice (DOJ) has launched an investigation into UnitedHealth’s Medicare Advantage billing practices. The probe focuses on whether the company exaggerated patient conditions to secure higher government reimbursements.

This regulatory overhang has rattled investors,UNH stock not only because of potential fines, but also due to the reputational risk in a highly competitive and politically sensitive healthcare environment.

- Keyword highlights: DOJ probe UnitedHealth, Medicare Advantage investigation, regulatory risk.

Leadership Changes to Steer Through Turbulence

In response to the current challenges, Stephen Hemsley has returned as CEO, replacing Andrew Witty. Hemsley, a familiar face at UnitedHealth, is expected to focus on operational discipline and cost management.

Additionally, Wayne S. DeVeydt will step in as CFO effective September 2, 2025. Both leadership changes are designed to stabilize the company and reassure stakeholders of its long-term strategy.

UnitedHealth has also announced planned premium hikesUNH stock of around 10% for Medicare Advantage in 2026 to offset cost pressures — a move that could improve margins but may also attract scrutiny from regulators and policy makers.

- Keyword highlights: new CEO UNH, leadership change, premium hikes Medicare Advantage.

Analyst Outlook: Cautious Optimism

Despite current setbacks, several major analysts maintain a cautiously optimistic stance on UNH. Morgan Stanley and Leerink Partners have pointed to the company’s scale, diversified business model, and strong cash flow generation as reasons for potential long-term recovery.

That said, most agree that the near-term will remain challenging until the DOJ investigation is resolved and cost pressures ease.

- Keyword highlights: analyst ratings UNH, price target, long-term healthcare investment.

Dividends and Fundamentals

For income-focused investors, UnitedHealth UNH stock continues to deliver value through dividends. The company has declared a $2.21 per share dividend payable on September 23, 2025, to shareholders of record on September 15.

On valuation, UNH trades at a P/E ratio of around 10–11, with a dividend yield in the 3.4–3.5% range. Strong free cash flow and healthy financial ratios indicate that the company remains fundamentally solid despite the current stock slump.

- Keyword highlights: dividend UNH, P/E ratio, free cash flow, healthcare stock yield.

Risks vs. Opportunity

Investors weighing UNH stock today face a clear trade-off. On one hand, rising costs, legal challenges, and volatile earnings create short-term risk. On the other hand, UnitedHealth’s dominant market position UNH stock, diverse revenue streams via Optum and UnitedHealthcare, and Buffett’s endorsement suggest long-term resilience.

For value investors, especially those with a multi-year horizon, current prices may represent an attractive entry point — provided they can tolerate near-term turbulence.

Conclusion: Should You Buy UNH Stock Now?

The combination of Buffett’s investment, solid fundamentals, and a strong market position makes UNH an intriguing opportunity for patient investors. However, the legal and cost-related headwinds mean that this is not a risk-free bet.

Ultimately, whether UNH belongs in your portfolio will depend on your risk tolerance, time horizon, and view on the U.S. healthcare market’s long-term trajectory.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research before making any financial decisions.